The high price of tertiary learning, and the toll that it has on student’s lives, is one of the most disingenuous and shameful aspects of education. In a perfect world and ideal society, education would be fully public and well funded. This would provide an opportunity for individuals of all backgrounds to have a well-rounded pedagogical experience. This is not the reality within many of the world’s nations, especially the United States of America where debts incurred by students currently totals more than $1.6 trillion (Hahn, 2023). Nearly forty-three million students and counting are significantly impacted by the exuberant cost of obtaining a degree in colleges and universities. Even though president Joe Biden passed a debt relief plan that provides $10,000 of federal student debt relief, or up to $20,000 for those who received a federal Pell Grant (Hotchkiss, 2022), these sums represent a mere fraction of what many students are on the hook for due to inflation on interest rates and predatory practices by loan providers.

Artists and educators are high among the list of professions where individuals working in the field are impacted by the debt from their student loans. For artists, it is somewhat of an unwritten law of the land that going to art school puts you in a better position to obtain career-based accolades like gallery representation, teaching positions, residencies or grants. However, art school is not an economically sound investment for many artists. The cost outpaces the average salaries that art world professionals make in a year. Furthermore, taking out loans with rapidly increasing interest rates sets many borrowers on the path of no return. The amount they owe becomes nearly impossible to pay back in relation to their wages and cost of living. Educators also have a hard time making ends meet due to the struggle of trying to pay back their debts while being underpaid in their jobs. According to research by the National Education Association (NEA), “nearly half of all educators took out student loans to pay for college, and they still owe $58,700, on average. Among them, one in seven still owes more than $105,000” (Flannery, 2021).

Two of the numerous former students facing a mountain of student loan debt include artists Mart Veldhuis and Kelli Rae Adams. They each have employed their artistic skills towards addressing the volume and burden of the student loan crisis.

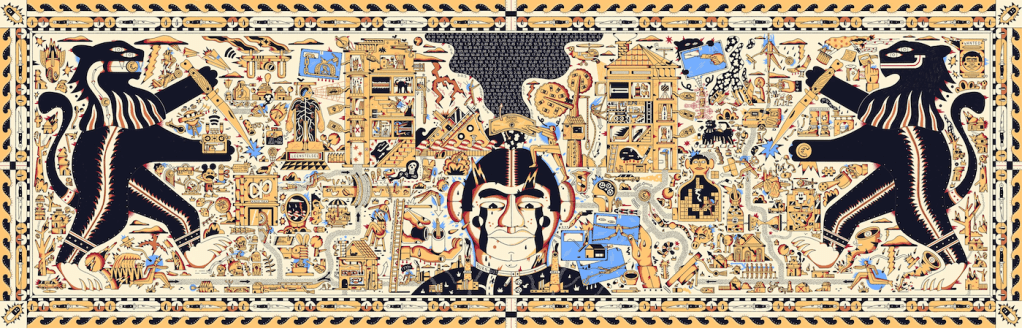

Current price: €45.879,40 netto (price will go up in conjunction with the artist’s student loan interest). Courtesy of the artist.

Veldhuis’ Eigen Schuld (2021) is a large tapestry full of symbolic forms and figures related to the burden student loan debt has on a variety of individuals and groups throughout society. The title is a play on words in the Dutch language meaning either “your debt” or “your fault.” This double entendre represents the ways in which student loan debt impacts the overall quality of life of a former student, as well as the negative connotations some people have for those who are suffering while trying to pay off their loans. The latter retort is common among socially or economically conservative sectors, who misunderstand the issue of student loans being predatory and cannot empathize with those who unfortunately have to rely on them to get the type of good education that everyone deserves. A common misconception among those who argue against student debt relief is that these borrowers are young, entitled and are a burden on the economic system and society at large. That argument is factually unsound and an activist named Alan Collinge is working to dispel these narratives to show how “claims that loan cancellation would unfairly benefit people who don’t need it, and even increase the wealth gap are nonsensical” (Collinge, 2020).

Another conceptual component expressed through Veldhuis’ Eigen Schul, is that the total value of his own student debt determines the selling price of the tapestry. As of April 2023 that debt was €45.879,40. He notes that “with this amount I link the financial reality to the physical reality of the carpet as a statement to increase awareness about student debts and the consequences of the social student finance system in the Netherlands. The goal is to hang the tapestry in a government building to encourage politicians to consider the consequences of the social student finance system.”

Courtesy of the artist and MASS MoCA.

Adams also utilizes a time honored medium to visualize student loan debt’s massive impact. Her installation Forever in Your Debt comprises hundreds of wheel-thrown ceramic vessels that are collectively able to hold the average value of individualized student loan debt in the U.S., which is $37,000. Each bowl holds roughly forty dollars when full of coins. Each bowl also signifies the cost of labor and value associated with her artistic practice. The income made from one bowl is a mere fraction of the incurring debt that is owed. The sheer amount of bowls filling the gallery space indicates the disparity between the cost of getting an education and the potential earning salaries post-graduation.

While it is installed at MASS MoCA through the fall of 2023, Forever in Debt elicits viewer participation by prompting visitors to fill the bowls with their own loose change. When empty, viewers will notice the bowls’ deep red interior glaze, which is a visual metaphor for the term “in the red,” i.e. owing more money than they are able to earn. As they fill the bowls with change the red hue becomes obscured. This powerful aesthetic representation is twofold: it reflects the tedious and nearly insurmountable process of incrementally paying off student loan debt, and communicates –pun intended– that a massive change is needed. The interactive visual experience heightens the data driven and pragmatic approach taken by advocates for student loan cancellation, such as Senator Elizabeth Warren. In fact, Warren responded to seeing Forever in Debt by saying “thank you Kelli, I am very grateful to you for tackling the issue of student loan debt from another perspective and for showing us right down to the level of the heart, what it means to carry debt like this.”

Art that addresses major societal issues is often strategically immersive, experiential and heartfelt, and is intended to inspire emotional responses and critical thinking. Being able to visualize the abstract reasoning of economic concepts through tangible and relatable perspectives, is indicative of art’s transformative outcomes which are just as significant as legislation.

References, Notes, Suggested Reading:

Collinge, Alan. “The Conservative Case for Canceling Student Loans,” Medium, 22 November 2020. https://studentloanjustice.medium.com/the-conservative-case-for-cancelling-student-loans-9e085a168972

Flannery, Mary Ellen. “The Depth of Educators’ College Debt,” NEA News, 27 July 2021. https://www.nea.org/advocating-for-change/new-from-nea/depth-educators-college-debt

Hahn, Alicia. “2023 Student Loan Debt Statistics: Average Student Loan Debt,” Forbes, 9 May 2023. https://www.forbes.com/advisor/student-loans/average-student-loan-debt-statistics/

Hotchkiss, Sarah. “For Many Artists, That $10K of Student Debt Relief is a Drop in the Bucket,” KQED, 11 October 2022. https://www.kqed.org/arts/13920126/student-debt-relief-biden-artists-grad-school-mfa

Discover more from Artfully Learning

Subscribe to get the latest posts sent to your email.

Adam, one of my pet peeves is the trend among baby boomers who had almost no student debt to reject education funding. The hypocrisy is just over the top.

LikeLiked by 1 person